Service Agreements and Loan Agreements. Stamp duty of a lease agreement.

Upfront Costs Of Purchasing A Home In Malaysia Propsocial

Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the.

. For property price exceeding RM75 million legal fees of the excess RM75 million is negotiable but subjected to maximum of 05. Shares or stock listed on Bursa Malaysia. 1 Legal Calculator App in Malaysia.

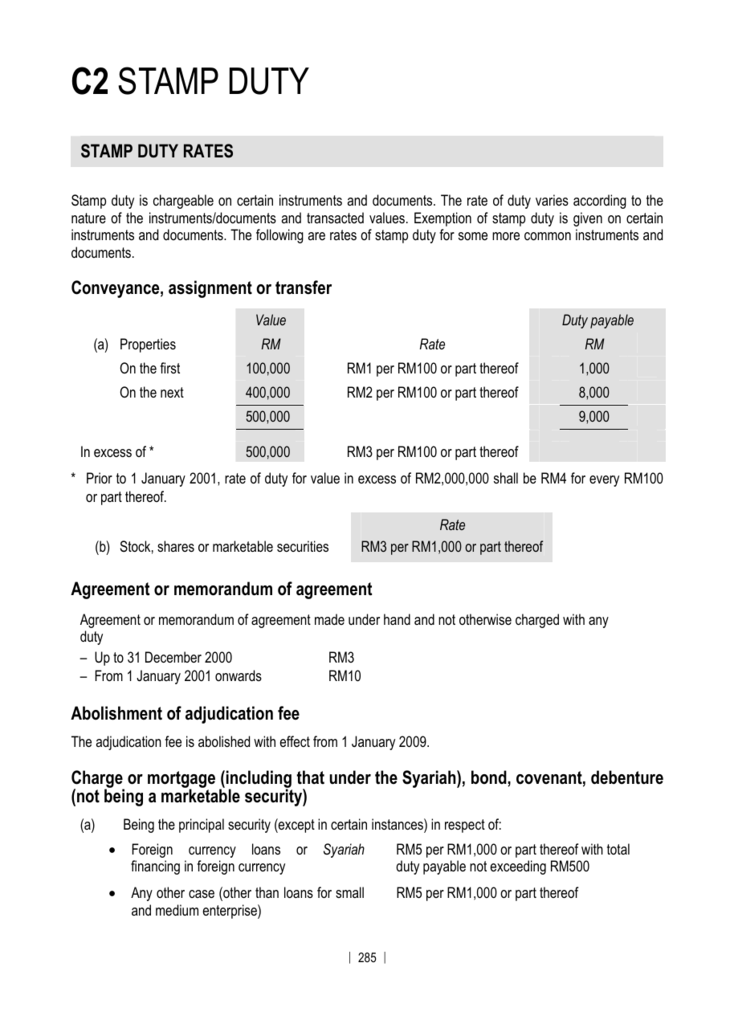

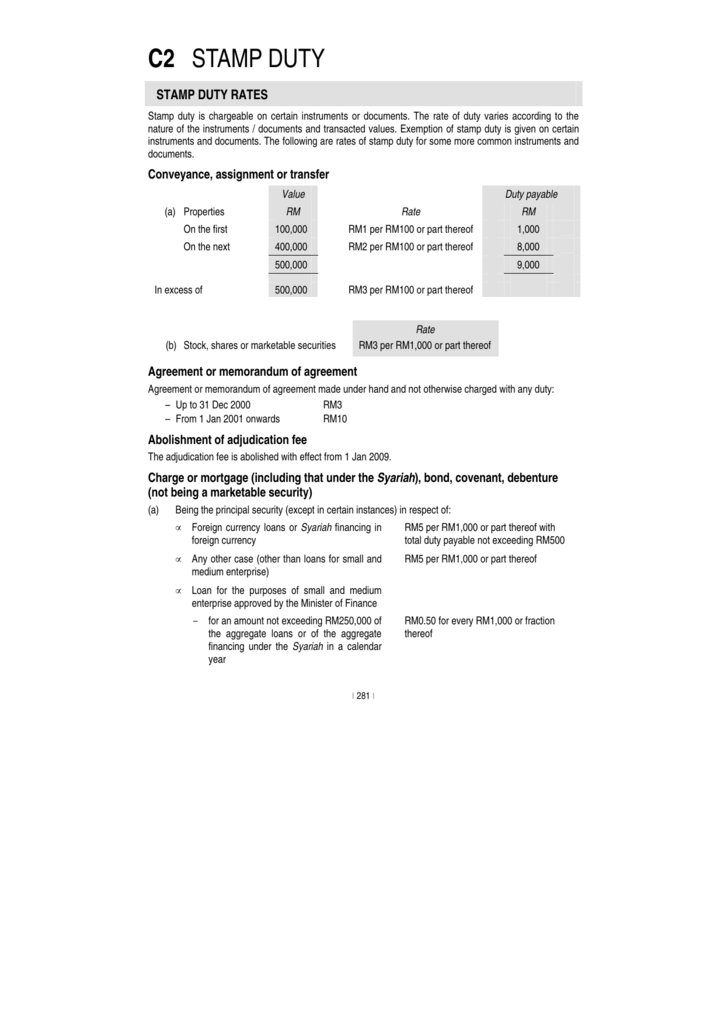

STAMP MALAYSIA wwwhasilgovmy LEMBAGA HASIL DAI-AM NEGERI MALAYSIA LHDNMR1416 INTRODUCTION Stamp duty is a duty imposed on document instrument listed under. For every RM100 or fractional part of RM100 of the contract price or the market value of the property whichever shall be greater. Stamp Duty for Loan.

The exemption applies for a maximum loan amount of RM500000. Loan Sum x 05. Just use your physical calculator.

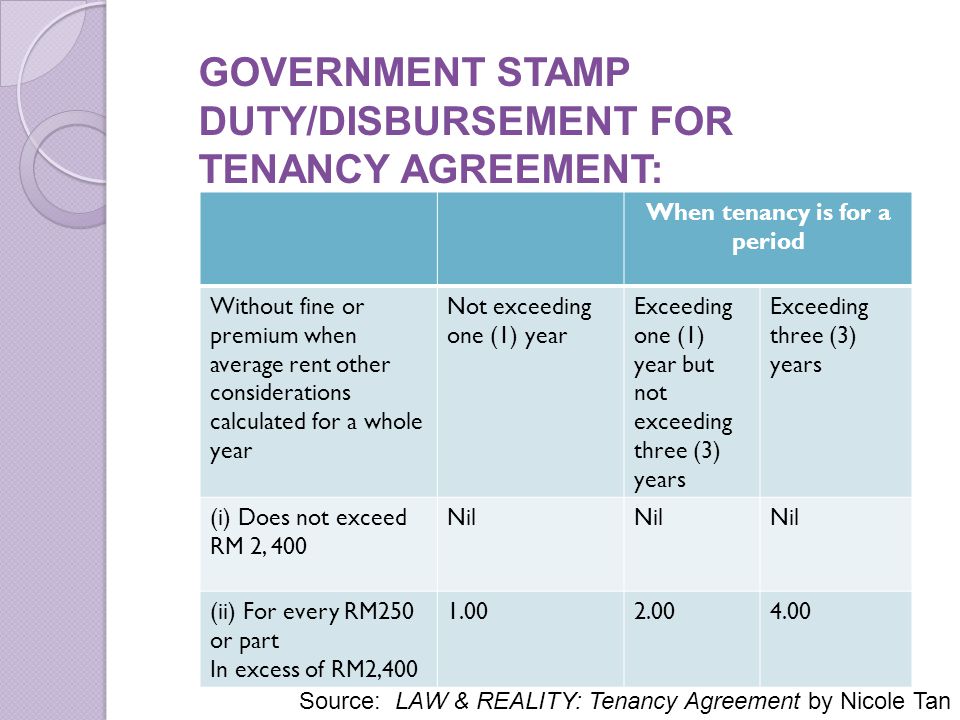

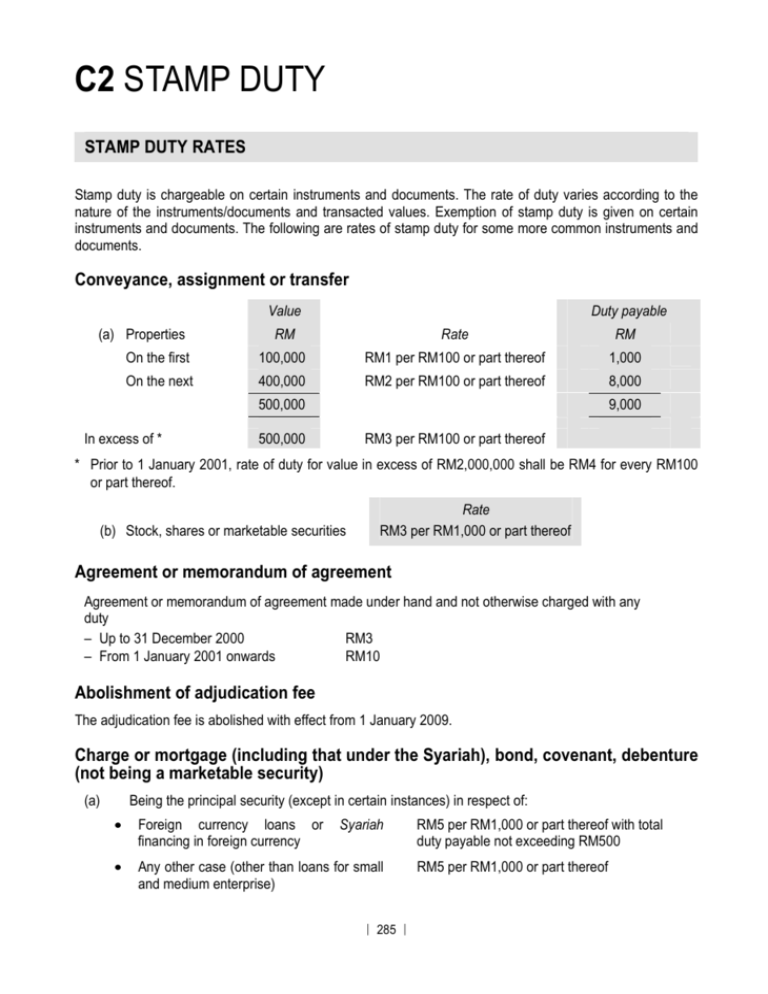

In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. Thursday 30 Dec 2021. Ii For contracts awarded by any party other than the Government stamp duty at Ad valorem rate will be levied on the contract between such party and principal contractor.

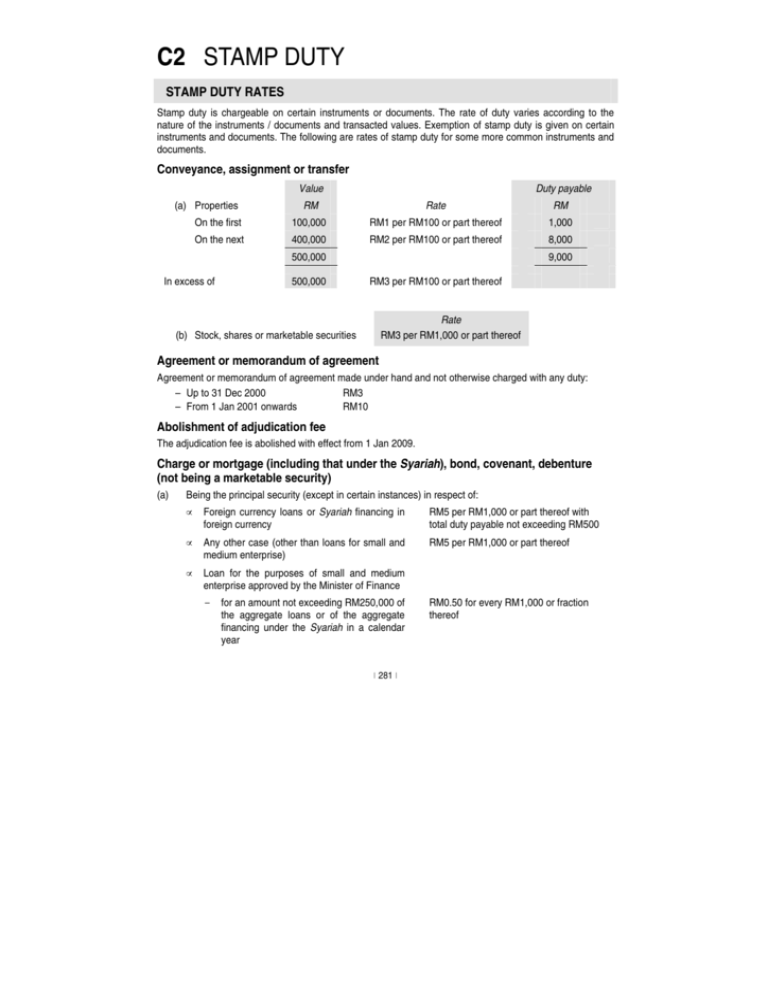

Before the ruling came into effect on Jan 1 2009 contractors only needed to pay a flat stamp duty of RM10 per contract. In summary the stamp duty is tabulated in the table below. Stamp duty for contracts at the third and subsequent levels will be fixed at RM5000 and any stamp duty paid in excess will be remitted.

The actual stamp duty will be rounded up according to the Stamp Act. We recommend users to contact us or download EasyLaw mobile - The No. Calculate now and get free quotation.

Full Stamp Duty exemption on instruments of transfer and loan agreement for first-time homebuyers is extended until 31st December 2025. Members of the Master Builders Association of Malaysia MBAM and its affiliates want the government to address the impact of the 05 ad valorem stamp duty imposed by the government on construction contracts. Stamp Duty Loan Calculation Formula.

Transaction costs include brokers commission stamp duty and clearing fees. Contractor and the sub-contractors. Corporate Compliance.

Defrauding the stamp duty LHDNM Disclaimer LHDNM e LHDNM 1-800-88-5436 LHDN This leaflets is issued for general information only. For shares or stock - the stamp duty is RM150 for every RM1000 or fractional part of the transaction value of securities payable by both buyer and seller. The calculator will automatically calculate total legal or lawyer fees and stamp duty or Memorandum of Transfer MOT.

Commercial Contracts. Ii RM2 on any amount in excess of theRM100000. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

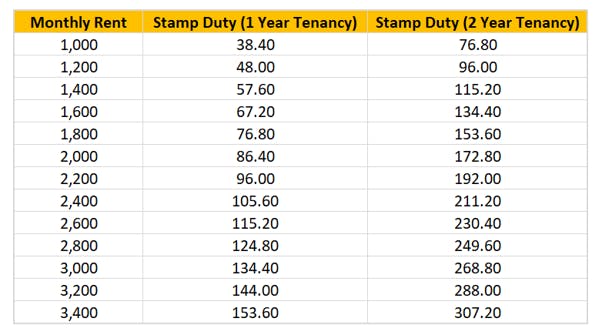

In general term stamp duty will be imposed to legal commercial and financial instruments. If the amount you get after you deduct the exemption of RM2400 from the rental per annum is NOT a multiple of 250 you need to round that figure up to the nearest and highest 250. As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement.

A the names of the parties and the date of execution of the agreement referred to in Paragraph 2 2 a or 2 2 b as applicable of the 2010 Order. RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000 wef. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia.

Stamp Duty Loan Calculation Formula. One very important thing to remember about the calculation for stamping fee is. If the loan amount is RM500000 the stamp duty for the loan agreement is RM500000 x 050 RM2500.

You dont need a loan stamp duty calculator to calculate this. For the ad valorem duty the amount payable will. The loan agreement Stamp Duty is 050 from the loan amount.

Following the most recent announcement by the authorities on Stamp Duty calculations for Contract Notes please be informed the following rates will be effective from 01012022 Relating to the sale of any shares stock or marketable securities. There are two types of Stamp Duty namely ad valorem duty and fixed duty. Transaction costs are expenses incurred when shares are bought or sold.

Additional copy of stamped Tenancy Agreement. Bursa Malaysia Bhd has lauded the Ministry of Finances MoF decision with regards to the remittance of stamp duty on contract notes for the trading of listed. It does not contain final advice or.

To be eligible for stamp duty remission under Paragraph 2 3 of the 2010 Order a sub-service agreement or sub-sub-service agreement must state. RM192 RM10 RM202. I got the following table from the LHDN Office.

B the subject matter of the agreement. The stamp duty Exemption 2022 as per the Budget 2021 announcement and further promoting homeownership especially for first-time buyers are below. Stamp duty of 05 on the value of the services loans.

The stamp duty is free if the annual rental is below RM2400. STAMP DUTY EXEMPTION 2021. The stamp duty chargeable on the Sale and Purchase Agreement is RM10 each.

It has to be based on the amount of monthly rental and the lease period-RM4 for every RM250 of the annual rental above RM2400. The stamp duty rate is prescribed under the Stamp Act 1949. With regard to the Memorandum of Transfer the rates of the duty are as follows.

Below is the stamping fee calculation. Please note that the above formula merely provides estimated stamp duty.

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

C2 Stamp Duty Malaysian Institute Of Accountants

Malaysia Stock Calculator Apps On Google Play

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide

Drafting And Stamping Tenancy Agreement

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Ec Realty

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Ws Genesis E Stamping Services

Everything You Need To Know Before Signing A Tenancy Agreement Instahome

Issues In Tenancy Matters In Malaysia Ppt Download

Stamp Duty In Malaysia Everything You Need To Know

C2 Stamp Duty The Malaysian Institute Of Certified Public

C2 Stamp Duty The Malaysian Institute Of Certified Public

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

Everything You Need To Know Before Signing A Tenancy Agreement Instahome

C2 Stamp Duty Malaysian Institute Of Accountants

Malaysian Stamp Duty Handbook 6th Edition Marsden Professional Law Book

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My